|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

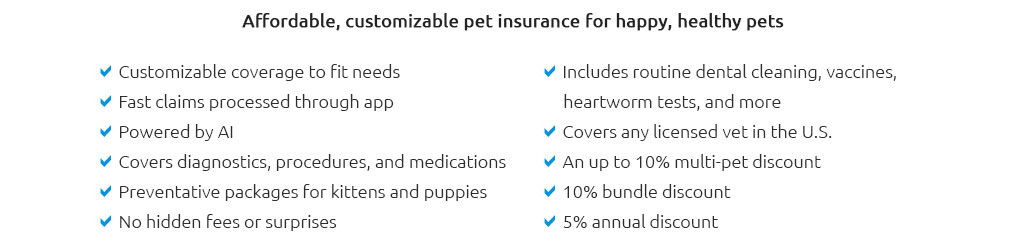

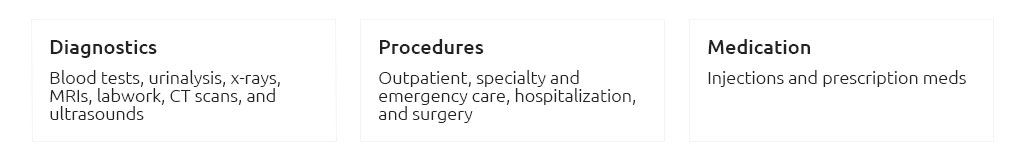

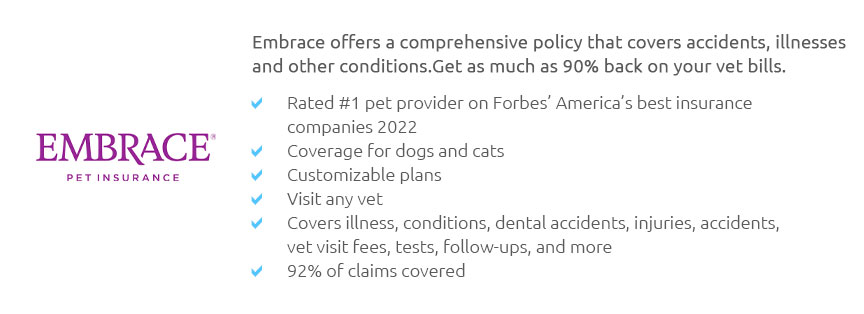

Understanding Pet Insurance and Wellness Plans: Making Informed DecisionsIn today's world, where pets are cherished members of the family, ensuring their health and well-being is a priority for many pet owners. As veterinary costs continue to rise, the concept of pet insurance and wellness plans has garnered significant attention. But what exactly do these plans entail, and how can they benefit both pets and their owners? Let's delve into the intricacies of pet insurance and wellness plans to help you make informed decisions. Pet Insurance: A Safety Net for Unexpected Events Pet insurance primarily functions as a financial safety net, covering unexpected veterinary expenses arising from accidents, illnesses, and injuries. This type of insurance typically reimburses a percentage of the vet bill, depending on the plan chosen. Policies often include a range of coverage options such as surgeries, medications, diagnostic tests, and even hospital stays. However, it's important to note that most pet insurance plans do not cover pre-existing conditions, routine care, or preventive treatments. Pros and Cons of Pet Insurance

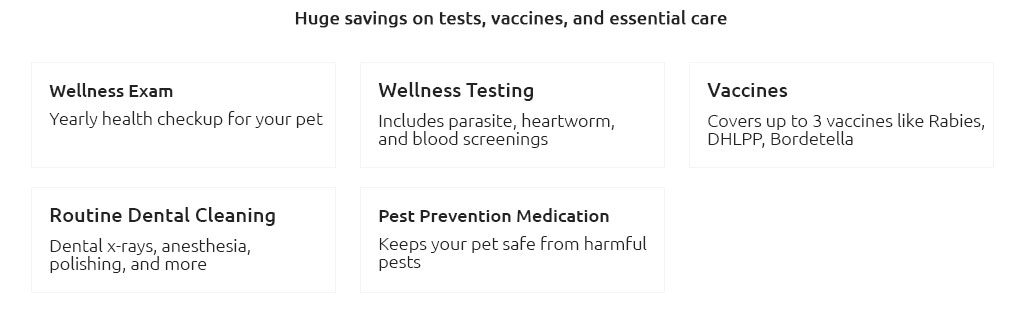

Wellness Plans: Emphasizing Preventive Care In contrast, wellness plans are designed to cover routine and preventive care, such as vaccinations, flea and tick treatments, dental cleanings, and annual check-ups. These plans often work on a subscription basis, allowing pet owners to budget for regular care throughout the year. Unlike pet insurance, wellness plans typically do not cover emergency treatments or unexpected illnesses. Pros and Cons of Wellness Plans

Finding the Right Balance For many pet owners, the decision between pet insurance and wellness plans is not an either-or scenario. Instead, they may find value in combining both, ensuring comprehensive coverage that addresses both unexpected and routine needs. Evaluating your pet's health history, lifestyle, and potential risks is crucial in determining the right approach. In conclusion, while pet insurance and wellness plans serve different purposes, they are both instrumental in safeguarding the health and happiness of your furry companions. By carefully assessing the options and understanding the nuances of each, you can make informed decisions that align with your pet's needs and your financial situation, ultimately ensuring that your beloved pets receive the care they deserve. https://wagmo.io/

Wagmo provides the best pet insurance and pet wellness plans that won't break the bank. We go above and beyond what other typical Pet Insurance Companies ... https://spotpet.com/wellness

What are Pet Wellness Plans? Spot's wellness add-ons include vaccine coverage, wellness exams, dental cleanings, and more. Pet wellness plans can be added to ... https://www.petinsurance.com/whats-covered/

Learn more about Nationwide pet insurance coverage. Plans typically cover wellness, illness, and emergency. Up to 80% back on vet bills. 877-263-6008.

|